| Fitch Affirms Credicorp Bank’s Long-Term IDR at ‘BB+’; Outlook Stable Panama, October 06, 2025 – Fitch Ratings has affirmed Credicorp Bank, S.A.’s Long-Term Issuer Default Rating (IDR) at ‘BB+’, Short-Term IDR at ‘B’, Viability Rating (VR) at ‘bb+’ and the Government Support Rating (GSR) at ‘No Support’ (‘ns’). Fitch has also affirmed Credicorp’s Long- and Short-Term National Ratings at ‘AA(pan)’ and ‘F1+(pan)’, respectively. The Rating Outlook for the Long-Term IDR and Long-Term National Ratings is Stable. Key Rating Drivers Operating Environment with Moderate Influence: Panama’s sovereign rating (BB+/Stable) and broader operating environment moderately influence Credicorp’s VR, with the sovereign rating continuing to cap the Operating Environment (OE) score despite | fundamentals that point to a ‘bbb’ category. While GDP growth has slowed and interest rates remain high, system credit growth, asset quality, and profitability are outperforming Fitch’s expectations. Fitch projects GDP per capita and Operational Risk Index (ORI) to remain stable and continue to preserve operating conditions for banks. Consistent Business Profile with High Capitalization: Credicorp’s international and national scale ratings are driven by its ‘bb+’ VR. Fitch views Credicorp’s business profile as strong, supported by conservative risk management, which has led to good asset quality and resilient profitability. Credicorp’s capital strength significantly influences Fitch’s decision to rate the bank at the same level as the Panamanian sovereign and mitigates the risks inherent in its business model. (Continue..) |

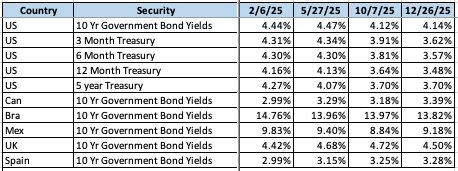

Interest Rates Data:

| Latin American Sovereign External Issuance Surges in 1H25 Latin America, July 23, 2025 – Latin American sovereign hard currency issuance surged to USD38.6 billion in 1H25, a 54% increase from the previous year and nearly matching the total for all of 2024, Fitch Ratings says in a new report. Ten sovereigns accessed external markets despite global geopolitical volatility and persistent high US policy rates, as emerging market sovereign spreads narrowed since the April ‘Liberation Day’ spike. However, volatility could return after the US tariff pause ends in August. Issuance continues to be mainly in US dollars (73%), but this proportion is down from 91% in the first half of 2024, | reflecting increased regional interest in diversifying currency exposure. Chile and Mexico issued euro bonds and Uruguay debuted Swiss franc bonds, while Panama stayed out of capital markets but raised significant funds via euro and Swiss franc loans. Activity also continued in global local currency-linked bonds (Dominican Republic, Paraguay). Barbados returned to international markets with bonds featuring the world’s first pandemic clause, following its 2019 bond with natural disaster provisions. Fitch rated the bond in line with the sovereign’s rating, noting that payment deferrals under the clause would not be considered a default. (continue…) |

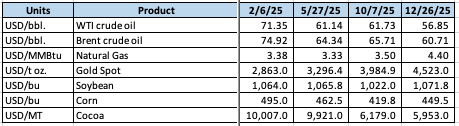

Commodities Data:

You must be logged in to post a comment.