Costa Rica, February 10, 2020 – The Government of Costa Rica (B2 stable) Ministry of Finance announced a series of measures to reduce the country’s fiscal deficit, including plans to sell Banco Internacional de Costa Rica, S.A. (BICSA, B1 stable b11).

The sale would be credit negative for BICSA, a Panamanian wholesale bank owned by Costa Rican state-owned Banco de Costa Rica (BCR, B2 stable b2), which holds 51% of its capital; and Banco Nacional de Costa Rica (BNCR, B2 stable, b2), which holds 49% of its capital. The sale creates uncertainty about BICSA’s future direction and whether it will remain focused on providing corporate and correspondent banking services for Costa Rican and Panamanian export companies. Management may also take a more cautious approach to growth during the transition period, which would negatively affect business volume, revenue generation and profitability.

As a wholesale bank, BICSA is highly dependent on market funding. As of September 2019, market funds accounted for 46.4% of total banking assets. Most of the bank’s liabilities are short term, with more than 60% expiring in less than a year. BICSA is also 67% funded by foreign investors, making it more vulnerable to refinancing and repricing risk that could increase funding costs and adversely affect its profitability.

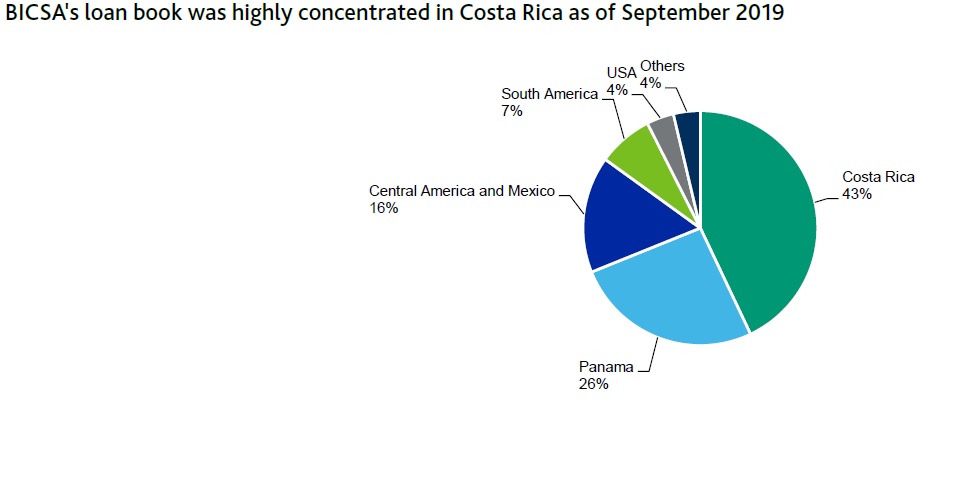

Given BICSA’s relatively small market share and its niche presence in Panama and Central America, the links and relationships between BICSA, BCR and BNCR are essential for its business development and franchise growth. As of September 2019, BICSA’s loan book was 43% concentrated in Costa Rica (see exhibit), which is its main market with significant presence in the corporate sector. In addition, in recent months, and supported by its shareholders, BICSA started to operate in Costa Rica’s leasing segment.

According to the Minister of Finance of Costa Rica, BICSA’s sale value could reach 0.04% of the country’s GDP, which is approximately $300 million. The sale of the bank could take several months if it were to require changes in laws that need congressional approval.

Credit Outlook: 17 February 2020. Pg. 22

Moodys