Mexico, March 12, 2020 – Global benchmark oil prices plunged for the second time in a week on concern about a price war stemming from Saudi Arabia’s plan to increase output despite signs of flagging global demand. The benchmark Mexican price (Mezcla Mexicana) declined to $23.58 per barrel, a 34% drop since the end of the previous week that left the price well below the $49 per barrel price embedded in Mexico’s 2020 federal budget assumptions. The price shock will weaken growth in certain federal transfers to Mexican regional and local governments (RLGs) that are funded in part with oil revenue, a credit negative. Nonetheless, the sector will benefit from contingency funds and hedging contracts in 2020, softening the financial effect in the sector through the end of the year.

Non-earmarked federal transfers (participaciones) account for slightly more than a third of total revenue among Mexican states, and while these transfers are mostly funded with federal tax collections, they also rely on oil revenue that flows into Mexico’s Oil Fund for Stability and Development. Without a global oil price recovery, and given expectations that production will not rise significantly this year, oil revenue will likely decline in 2020, creating modest financial pressure for RLGs as slowing economic growth creates other headwinds in the sector.

After Mexico’s GDP contracted 0.1% in 2019, we expect GDP will rise just 0.9% in 2020 and that slow growth will weaken other tax collections that also fund federal transfers. Even before the oil price shock, the government projected just 3.9% nominal growth in participaciones in 2020, well below the 8.5% average growth rate during the previous five years.

We estimate that in a scenario in which prices fail to recover throughout the year, growth in participaciones would be lower than the 3.9% rise projected in the budget, though certain offsetting factors will help limit the shortfall. For one, dependence on oil revenue among Mexican RLGs has declined in recent years. Between 2012 and 2014, for example, oil revenue accounted for 29% on average of total revenue that funded participaciones, versus 12% on average between 2017 and 2019.

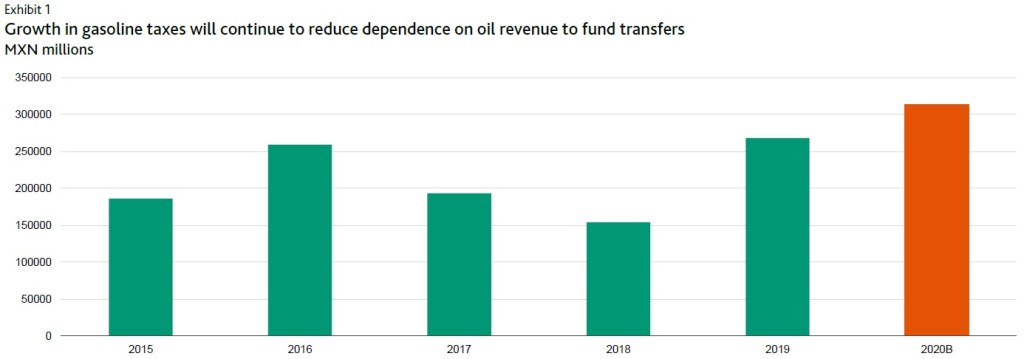

In addition, lower oil prices will give Mexico more flexibility to eliminate for the rest of the year a fiscal stimulus that previously applied to a federal excise tax on gasoline sales (IEPS)1 – another revenue source that funds participaciones – which will help offset the drop in oil revenue2. In periods where rising oil prices lead to increases in the price of refined fuels, the government has applied a stimulus that effectively subsidizes the IEPS tax with the goal of smoothing price increases for consumers. Conversely, when oil prices fall the government is able to reduce the subsidy, resulting in a rise in IEPS collections. The government’s budget projects a 17% increase in the IEPS tax on gasoline in 2020 (see Exhibit 1).

Although we anticipate slow growth in participaciones from lower oil prices, Mexican RLGs will nonetheless benefit from the Fondo de Estabilización para los Ingresos de las Entidades Federativas (FEIEF), a contingency fund, which will make up for any shortfall between budgeted and actual participaciones in 2020. This will help alleviate stress for RLGs this year, but would leave a smaller buffer to absorb future shocks (see Exhibit 2). The FEIEF currently has enough resources to absorb up to a 6.4% decline in participaciones from the levels budgeted for 2020.

Finally, other federal transfers that are earmarked primarily for infrastructure projects will likely benefit from the federal government’s hedging contracts, which on average provide coverage against a drop below $49 per barrel. These hedges will insulate the federal government’s budget overall from the oil price shock, allowing it to continue sending the earmarked transfers, which accounted for approximately 12% of total revenue among Mexican RLGs last year. Stability in these transfers will help limit financial stress for RLGs. Nonetheless, revenue provided by the hedging contracts does not cover participaciones, which are only funded with tax and oil revenues, and therefore wouldn’t benefit from any gains from a hedging contract.

Credit Outlook: 16 March 2020. Pg. 46

Moodys