United States, April 13, 2020 – Incoming data in the US (Aaa stable) is beginning to capture the extent to which the coronavirus shock is likely to weigh on the economy. But this rapidly unfolding recession, particularly the way in which it is impacting the economy, is qualitatively different from past business cycle downturns. Unlike previous economic downturns, this shock has its roots outside the economy. The contraction in economic activity is driven by public health policy measures that are aimed at limiting the scale of human suffering from to the spread of the disease. This has resulted in an almost overnight shutting down of a large number of ways in which individuals engage with one another in the economy.

The massive economic consequences are becoming more clear with every incoming data print, particularly with regards to the labor market. Unlike past recessions, where the repercussions to firms’ earnings and to households’ incomes materialized over several quarters, this time around the income and employment shocks are upfront and immediate.

The unusual nature of this shock and the damage it is causing to the economy is particularly evident in labor market data. The latest establishment survey shows that in just one month, from February to March, payroll employment was slashed by 701,000. (By comparison, during the last recession, which accelerated after Lehman Brothers collapsed in September 2007, job losses only started to mount in February 2008 and took five consecutive months to reach a similar level of job losses on a cumulative basis.) As a result, the unemployment rate increased to 4.4% in March from 3.5% in February as per the household survey. However, the precipitous rise in new weekly jobless claims since the week of 16 March (after the March establishment and household surveys were completed) shows an unprecedented 16.8 million job losses in a matter of just three weeks. This amounts to a staggering unemployment rate of 14%, from the 4.4% in March.

It is very likely that job losses will continue to mount through April as thousands of businesses struggling to keep afloat relieve workers in an attempt to cut costs. However, fiscal support and incentives for businesses to maintain payroll will likely slow the pace of layoffs in coming weeks, 1 April 2020.

Most job losses are in the services sector and are temporary for now. A closer look at these early labor market indicators reveals that a large proportion of the layoffs are temporary, which means that many businesses expect to rehire once demand picks up again (see Exhibit 1). Furthermore, most of the workers facing job losses are in low paying jobs on hourly wages, or engaged in temporary work. We expect that government support to households and businesses would partially mitigate the income and job losses, particularly if the economy restarts and businesses begin to reopen after this brief second quarter pause due to the stay-at-home measures. Although there is a risk of uneven benefit distributions resulting in permanent job losses in some sectors, the economic costs would magnify with a longer lasting shutdown.

Of the 701,000 payroll job losses in the March establishment survey, 650,000 were in the services sector. And in the services sector, leisure and hospitality were the worst affected as this was the first sector to see a compression in demand (see Exhibit 2 and 3). The wave of job losses since mid-March, which will be captured in the April non-farm payroll data, are likely to show increasing layoffs in other services sectors as well, such as retail and construction.

Longer-term labor market outcomes will depend on the duration of quarantines and the effectiveness of fiscal and monetary policy measures. With layoffs surging across industries, as many as 20 million individuals could lose their jobs in a matter for weeks. In addition, many are likely to see their hours curtailed. And while most of the job losses have so far been among low paid workers, high paid workers will likely experience pay cuts the longer it takes for the economy to restart.

If stay-at-home measures and other efforts to contain the virus are effective enough to allow for a relaxation of social distancing measures, businesses will likely gradually resume normal operations in the third quarter. Under this scenario, which underpins our growth forecasts, individuals could return to their jobs, especially where layoffs are temporary. However, the pace of rehiring will likely be slow, as the fear of a renewed spread of the coronavirus is bound to linger for some time without a cure or a vaccine. We believe that the significant fiscal and monetary policy stimulus measures will provide a cushion to the economy in the interim period. In particular, measures aimed at limiting the damage to the balance sheets of households and firms would help jump-start the economy once the social distancing restrictions are lifted.

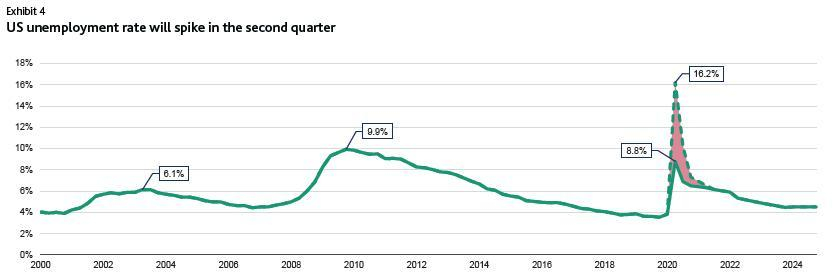

We expect the US unemployment rate to shoot up in the second quarter and to average anywhere between 8.8% and 16.2%, because of the scaling back of work and business closures in response to a sharp pullback in consumer demand (see Exhibit 4). The wide range indicates a significant likelihood of larger layoffs and furloughs in the coming weeks in sectors such as retail, transportation and construction, in addition to hospitality and leisure, which would push the unemployment rate to the high end of the range. In addition, we expect the unemployment rate to peak in the second quarter, and gradually climb down in subsequent months with a gradual resumption of normal economic activity.

We expect some of the job losses to be permanent for two reasons. First, some businesses, particularly small businesses, are unlikely to recover from this shock despite the substantial policy support. As a result, under our baseline forecast, unemployment will average around 6.5% by the end of the year.

Our expectation that the unemployment rate will peak in the second quarter is based on the significant fiscal and monetary stimulus measures being undertaken to support the economy (see Exhibit 5). The stimulus will also support households’ purchasing power and aid a gradual resumption of consumer spending in the third and fourth quarters.

There are downside risks to our growth forecasts if the economy remains shut beyond the second quarter. If that were to happen, the unemployment rate will increase further in the third quarter and many of the job losses that we are currently treating as temporary losses will likely become permanent. This would be additionally damaging, not only in terms of household income, but also as a loss of human capital, which takes time to build.

Credit Outlook: 16 April 2020. Pg. 35

Moodys