Brazil, September 1, 2020 – the lower house of Brazil’s (Ba2 stable) national congress approved law 6407/2013, also known as the “Natural Gas Bill,” an important step in the modernization of the natural gas industry in the country.

The bill provides an enhanced regulatory and contractual framework that will foster competition and spur up to BRL80 billion in annual investments along the gas supply chain, according to Brazil’s Ministry of Finance (FIRJAN). Natural gas prices will potentially decline around 40% with increased production rates over the next decade, which will lead to lower production costs for electro-intensive industries, a credit positive. The greater availability of natural gas will also contribute to a sustained diversification of Brazil energy matrix as gas-fired thermal power plants become more competitive in future energy auctions. The bill still needs Senate approval for take effect, a process that we expect to conclude within this month.

Approval of the new legislation follows several years of in-depth discussion among regulators and stakeholders, which gained momentum after the government launched the Gas for Growth (Gás para Crescer) program in 2016. The current administration revamped the program in July 2019 and Petroleo Brasileiro SA’s (PETROBRAS, Ba2 stable) asset divestment strategy are gradually reducing market concentration in the production, transmission, storage and distribution of natural gas. The anticipated development growth in offshore pre-salt oil reserves with multiple and independent exploration and production (E&P) companies will double the net supply of natural gas over the next 10 years from the 51 million cubic meters per day in 2019. A significantly larger supply will drive prices lower and reduce the reliance on natural gas sourced from Bolivia (B1 negative).

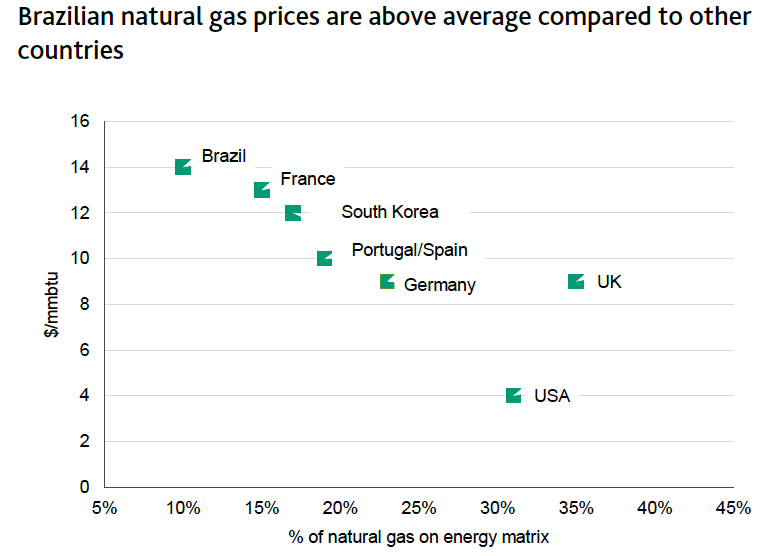

Prices paid by industrial end-users in Brazil have averaged over $14/million British thermal unit (MMBtu), while in Europe the same prices have averaged $7/MMBtu and in the US averaged $4/MMBtu (see Exhibit 1). In the context of possibly lower prices and easier procurement of natural gas, industrial demand will grow. The regulatory changes provide transparency and open access to the natural gas market, which could drive incremental demand growth of around 30% from those industries through 2029, according to Brazil’s energy research company, Empresa de Pesquisa Energética (EPE) (see Exhibit 2).

Brazil’s energy system will also benefit from greater availability of natural gas through a sustained reduction in prices and improved supply infrastructure. EPE estimates that the current installed capacity of gas-fired thermal power plants in the Brazilian energy matrix can reach 36.2 gigawatts (GW) by 2029, up from 12.9 GW in 2019. Natural gas-fueled thermal power plants can be a reliable alternative to tackle the intermittence of renewable energy generation and replace higher carbon emission sources like coal and oil.

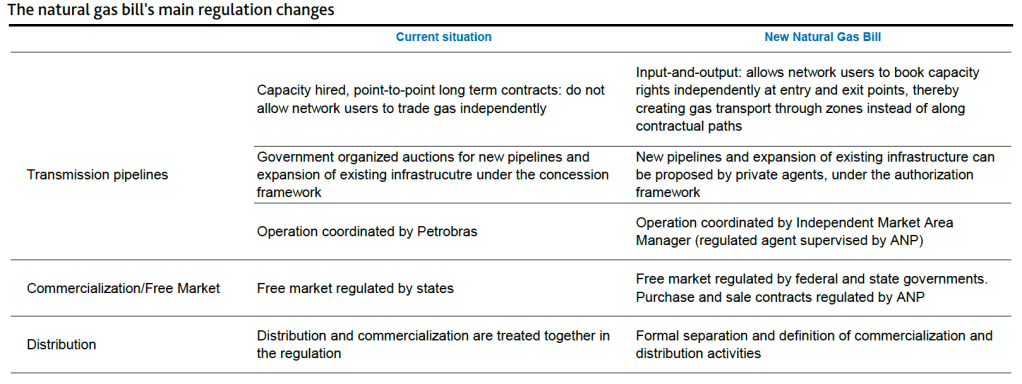

The new legal framework includes provisions to replace the concession system for development of new gas pipelines and commercialization units with an authorization permit procedure, subject to the regulatory oversight of the federal oil agency, Agência Nacional do Petróleo (ANP), which is expected to accelerate the investment rate for end users. It will also ensure open access to the transportation infrastructure (pipelines), which will benefit large industrial consumers of natural gas by allowing for procurement processes that do not depend entirely on the local distribution companies. Nonetheless, the regulation at the state level needs to advance in tandem with federal regulation, clarifying the compensation mechanisms for gas utilities and revenue tax charges (see Exhibit 3).

Credit Outlook: 7 September 2020. Pg. 11

Moodys