Spain, December 3, 2020 – Spain’s lower chamber of parliament passed a 2021 budget, the first budget to be approved since 2018. The bill must still be approved by the upper house before returning to the lower chamber for a final vote, which is expected by the end of the year. However, we anticipate limited amendments. The budget, which targets a general government deficit of 7.7% of GDP for next year, will facilitate the deployment of EU recovery funds key to Spain’s longer-term economic recovery – 2.1% of GDP of which are allocated in 2021 – and introduces several new structural revenue measures.

The budget bill passed at first reading with 188 votes in favour in the 350-seat Parliament. While this strengthens the position of the PSOE-Podemos minority coalition government, the reliance on a constellation of regional parties (nine in total) and the failure to obtain the backing of the centrist Ciudadanos will make it challenging to replicate stable parliamentary support in the future.

In recent years, the lack of a majority government and increased political fragmentation have prevented the passing of a budget and hindered the implementation of reforms to address Spain’s structural challenges. Hence, in 2019 and 2020, the government has had to operate on the previous administration’s 2018 budget after having been unable to find sufficient parliamentary support for a budget of its own. Before that, both the 2017 and 2018 budgets had only been adopted in the middle of the year. Under the Spanish budgetary provisions, the government can roll over the budget and is able to approve revenue and spending measures through decree. However, new taxes require parliamentary approval, and a new budget is a prerequisite to effectively implement the investment projects under the EU recovery funds.

The budget is predicated on relatively optimistic macroeconomic assumptions, with growth expected to rebound strongly in 2021 after this year’s coronavirus-induced shock – reaching 7.2% when excluding the impact of EU funds, and 9.8% when they are included. We project a more modest recovery of 6% (European Commission: 5.4%; IMF: 7.2%) after a projected contraction of 11.4% this year, given the large degree of uncertainty surrounding the recovery path across Europe and the global economy. In addition, we project uneven improvements across sectors – particularly tourism and high-contact services, important ones for Spain – as pandemic worries persist. Given our weaker growth outlook, we also forecast a more moderate narrowing in the budget deficit next year than the government’s expectation, to 8.6% of GDP as many of the pandemic-related support measures tail off and revenues start to recover.

The successful absorption of EU funds will be key to Spain’s longer-term recovery. The budget accounts for the use of around €26.6 billion (2.1% of GDP) in grants next year to strengthen investment, the largest part of which will be directed at projects relating to the green energy transition and digitalisation. The government estimates that the usage of the funds will add 2.6 percentage points to growth annually between 2021 and 2023, but much will depend on their effective implementation. While Spain is well placed to take advantage of the “green transformation” part of the EU’s recovery fund, the needed coordination between the central government and the regional administrations – an inevitability given Spain’s very decentralised system of government – is likely to be one of the main challenges to the funds’ execution. Also key will be the ability to allocate the funds toward high-quality investment projects that raise future productivity and potential growth.

Regarding the outlook for public finances, the 2021 budget includes a series of measures on revenues and spending. New structural revenue measures mark a step toward broadening Spain’s tax revenue base, one of the lowest across large euro area economies (35.4% of GDP in 2019, more than six percentage points below the euro area average of 41.6% of GDP). The measures, which include new taxes on digital companies and financial transactions as well as new steps to fight against tax fraud, are projected by the fiscal council AIReF to yield additional revenues of around €4 billion per year, equivalent to 0.3% of GDP. We expect any future consolidation to come largely through the revenue side given the political orientation of the coalition parties.

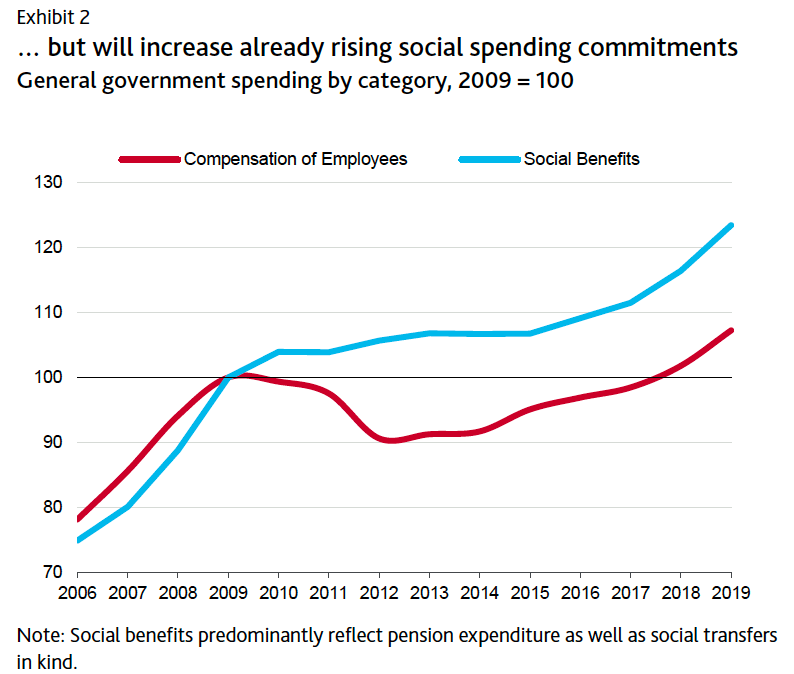

On the spending side, the budget will again increase social spending commitments, in particular through the relinking of pensions to inflation and higher public-sector wages. The public sector wage bill (around a quarter of total general government spending) and social benefits have increased strongly in recent years, in part reversing the consolidation efforts made in the aftermath of the global financial crisis and reducing budget flexibility. The budget also reflects the full-year impact of the new nationwide minimum income scheme, which will cost 0.2% of GDP.

Restoring the public finances to their 2019 level will be a protracted process. We expect Spain’s public debt ratio to rise above 120% of GDP by the end of 2021, an increase of around 25 percentage points from 2019, above the average across the largest advanced economies. Under our baseline assumptions, Spain’s public debt ratio will only stabilise near that level in the following years, leaving the country’s public debt among the highest in the world. That said, the very favourable funding environment and improvements in debt affordability will remain an important mitigating factor for the large increase in Spain’s debt burden.

Despite this year’s much higher issuance of government bonds, the government’s debt interest burden continues to decline as costlier debt is refinanced at lower rates; as of December, the average interest rate on the central government’s debt was 1.86% (from 3.11% in 2015) versus an average cost at issuance of just 0.21%.

Credit Outlook: 7 December 2020. Pg. 23

Moodys