Spain, September 26, 2025 – FitchRatings has upgraded Spain’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘A’ from ‘A-‘. The Outlook is Stable. Fitch has also upgraded Spain’s Short-Term IDR to ‘F1+’ from ‘F1’.

Key Rating DriversThe upgrade of Spain’s IDRs reflects the following key rating drivers and their relative weights:

High

Economic Outperformance: Spain’s economic performance has exceeded expectations and significantly outpaced other major eurozone economies. Economic growth is supported by large migration inflows and strong, increasingly diversified services exports. Recent productivity gains, moderate wage growth and relatively low energy prices have boosted external competitiveness and strengthened private external balance sheets. Fitch expects the economy to remain resilient, helped by limited exposure to US tariffs and ongoing net external deleveraging.

Growth Exceeds Expectations: We have raised our real GDP growth forecast for Spain to 2.7% in 2025 and 2.0% in 2026, reflecting stronger-than-expected quarterly growth in 1H25. Growth has been broad, with the services sector strengthening due to a rebound in tourism (with higher off-season inflows and quality upgrades) and solid performance in non-tourism services such as information communication technology and professional services. Business and consumer sentiment indicators are positive. The manufacturing sector (11% of gross value added) has benefited from increased solar and wind generation, which has helped lower electricity prices to well below the eurozone average.

Favourable Growth Prospects: Fitch has revised Spain’s potential growth estimate to 2% from 1.4%, mainly due to rapid expansion in labour inputs and supported by higher total factor productivity. Strong labour force growth reflects significant migration inflows, mostly from Latin America, while recent reforms and a shared language have supported labour market integration. Labour productivity growth has risen to over 1% annually from 2022 to 2024, compared with 0.3% between 2014 and 2021, although further improvements are needed to lift GDP per capita growth, which remains below headline growth.

Labour Market Supports Growth: Labour market conditions have strengthened significantly, with activity and employment rates reaching record highs, bolstering economic growth. Temporary employment has fallen to historical lows, supported by the 2022 labour market reform. The unemployment rate remains the highest in the euro area, at about 10.4% as of July, despite recent progress in reducing it.

Medium

Reduced External Vulnerabilities: Net external indebtedness continues to fall, extending the trend that began after the eurozone crisis and was interrupted only briefly by the pandemic. Net external debt declined to 44% of GDP at end-2024, down from a peak of 95% in 2013, driven by improving private external balance sheets and ongoing current account surpluses. The current account balance improved to 3.1% of GDP in 2024, supported by a stronger service surplus from tourism and diversification into non-tourism exports deficit. The primary and secondary income balance remain highly negative due to large remittance outflows and Recovery and Resilience Facility grants.

Fitch expects current account surpluses to average 2.6% of GDP between 2025 and 2027 (relative to an average deficit of 0.5% for the ‘A’ rated median), with net external debt falling below 40% of GDP, reaching 37% by 2027, gradually closing the gap to the net creditor position of the peer median of 6.1%.

Spain’s ‘A’ IDRs also reflect the following key rating drivers:

Rating Fundamentals: The ratings are supported by governance indicators consistent with the ‘A’ rating category and eurozone membership supporting institutional stability. These strengths are balanced against a still high public debt ratio.

Political Deadlock: Spain’s centre-left minority government increasingly struggles to secure parliamentary support, including for the passage of budgets since 2023, from smaller parties, including from the Catalan separatist party. Prime Minister Sánchez faces mounting pressure from corruption allegations involving the Socialist Party and family members, while political and regional fragmentation impedes progress on crucial reforms, including housing supply solutions and the development of a coherent fiscal consolidation strategy. Parliamentary elections are not due until 2027.

Moderate Fiscal Deficits: We forecast the general government deficit will fall to 2.6% of GDP in 2025 from 3.1% in 2024, driven by the absence of one-off expenses and continued revenue growth offsetting a gradual increase in interest costs. Spain will meet its NATO defence spending target of 2% of GDP this year, up from 1.4% in 2024, with a limited impact on the deficit due to spending reallocations and reclassifications. We forecast a deficit of 2.4% of GDP in 2026, reflecting the phase-out of flood relief measures, rising to 2.5% in 2027 as elections approach and interest expenses increase. This is slightly below the ‘A’ rated peer median of 3.1% in 2026 and 2.9% in 2027.

Fiscal Uncertainties: Pro-active fiscal consolidation efforts have been limited, in Fitch’s view, and fiscal improvement has been driven mostly by the phasing out of temporary measures and strong revenue growth supported by a solid labour market and robust GDP growth. Political fragmentation raises uncertainty about parliamentary approval of the 2026 budget, and Fitch expects the 2023 budget to be rolled over for a third consecutive year, with new measures likely passed on a law by law throughout the year.

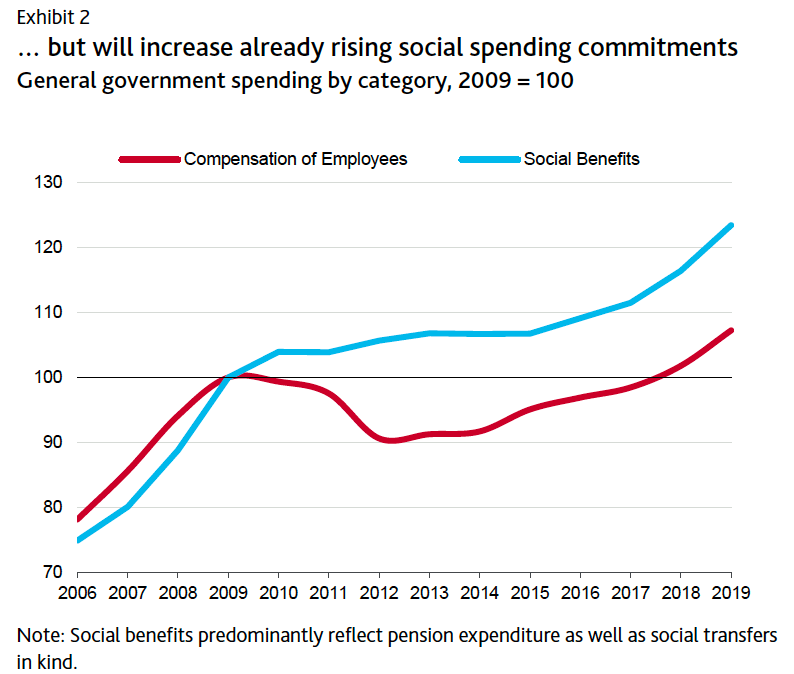

Fiscal uncertainty extends to the medium term due to the lack of a credible fiscal strategy. The government targets a deficit of 1.5% of GDP and a debt/GDP ratio of 94.8% by 2029 under its seven-year adjustment plan, but the plan lacks detailed measures and faces challenges from the absence of a budget and political majority for consolidation.

High Debt, Gradual Reduction: Fitch projects the general government debt ratio will fall from 101.6% of GDP in 2024 to 100.7% by 2027, and below 100% thereafter, supported by sound nominal GDP growth. This is high relative to the ‘A’ category median of 53.7%. However, we expect debt will temporarily increase in the short term, even as fiscal deficits narrow, due to Recovery and Resilience Facility funds and cash-to-accrual accounting adjustments totalling 3.6% of GDP in 2025-2026.

ESG – Governance: Spain has an ESG Relevance Score (RS) of ‘5[+]’ for Political Stability and Rights and the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. These scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Spain has a high WBGI ranking at 74, reflecting its long record of stable and peaceful political transitions, well-established rights for participation in the political process, strong institutional capacity, effective rule of law and a low level of corruption.

Source: Fitch Ratings

You must be logged in to post a comment.