Latin America, May 11, 2020 – Sovereigns in Latin America (LatAm) are facing the coronavirus shock with higher debt and interest burdens and less overall fiscal space than they had during the 2015-16 commodity price shock. At the same time, investor risk perceptions toward emerging markets have deteriorated, rendering financing conditions less favorable.

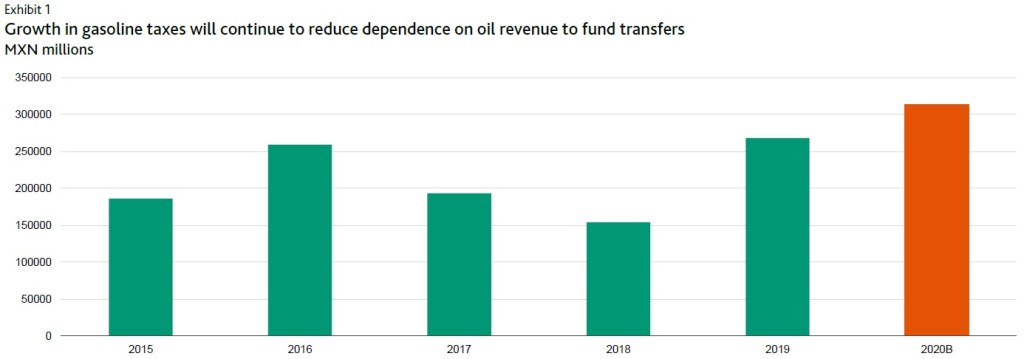

LatAm sovereigns will face increased funding challenges this year as they post larger deficits amid higher health-related spending, lower tax revenue intake as economies contract, and countercyclical fiscal measures, which include higher spending and tax payment delays in some cases. With access to the global financial markets affected by higher risk perceptions, persistent volatility and higher crossborder funding costs, sovereigns in the region will likely rely on alternative sources of funding (e.g., multilateral funding, local markets, fiscal buffers) to cover the anticipated increase in their borrowing needs.

» Fiscal metrics will deteriorate across the region as debt and interest burdens rise. We expect LatAm sovereigns to come out of the coronavirus crisis with weaker fiscal metrics. As the region’s economies contract and governments post wider fiscal deficits this year, debt burdens will rise by seven percentage points of GDP on average, with the median LatAm debt burden reaching 54% of GDP. And as debt stocks grow and borrowing costs rise, the median interest-to-revenue ratio in LatAm will increase to 13.7% in 2020 – almost two percentage points higher than in 2019.

» Risk differentiation by investors have led to uneven changes in relative borrowing costs across LatAm compared to prior episodes of financial volatility. Since March, spreads have widened more than in previous episodes of market volatility, including the 2013-14 “taper tantrum” period. But this time around, there is significant risk differentiation between lower rated sovereigns.

Although the benchmark US treasury rate has been declining, the average LatAm sovereign’s borrowing costs are almost 200 basis points higher than at the beginning of the year.

» Funding strategies to cover coronavirus response will be influenced by market conditions. Higher yields reflecting increased sovereign credit risk premiums will influence funding mix decisions through the rest of the year. We expect governments to rely more extensively on multilateral financing, local borrowing and other funding sources to cover wider fiscal deficits. Because governments will likely gravitate toward funding mixes that minimize interest costs for borrowings, this can partially mitigate the deterioration we anticipate in debt affordability.

Credit Outlook: 14 May 2020. Pg. 36

Moodys

You must be logged in to post a comment.