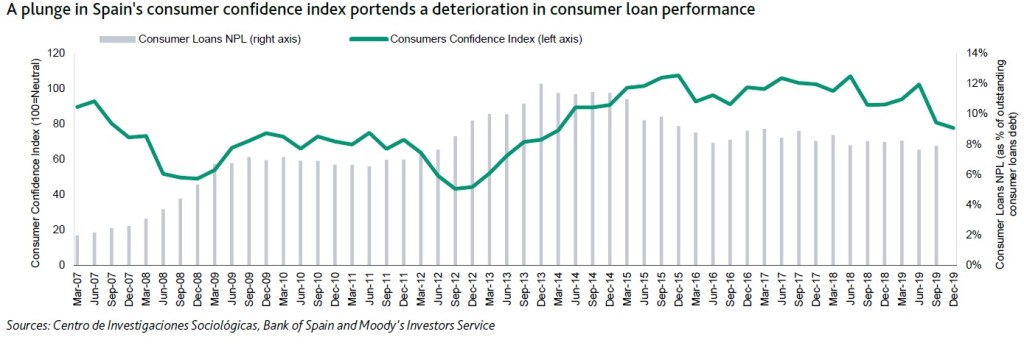

Spain, January 7, 2020 – Centro de Investigaciones Sociológicas (Center for Sociological Research, or CIS) reported that Spain’s consumer confidence index had plunged to 77.7 in December 2019, 13 points below the levels in December 2018 and the lowest level since 2013. The significant decline in consumer confidence, consistent with other negative data reported in recent days, is credit negative for asset-backed securitisations (ABS) collateralised by Spanish consumer loans. Consumer confidence data provide a forward indicator that asset risks will increase and consequently weaken the performance of securitised loans. Falling consumer confidence somewhat correlates to weaker future performance in consumer credit, as the exhibit shows. Indeed, consumer confidence plunged in mid-2007 before Spanish consumer nonperforming loan (NPL) ratios surged.

The sharp decrease in consumer confidence during the second half of 2019 reflects an increasing concern among Spanish consumers about the national economy and employment. We expect that borrowers will face more challenges repaying their consumer loans because of a gradual moderation in the growth performance of the Spanish economy: we expect GDP growth of 1.8% for 2020 compared to 3% growth in 2016-17. The decline in consumer confidence is consistent with other negative data reported in recent days, including a 4.8% drop in 2019 car registrations, according to data from Spain’s associations of auto manufactures (Anfac), dealers (Faconauto) and vendors (Ganvam). The drop is the first in Spain since 2012.

Adding to these challenges is that consumer lending continues rising despite indications of economic deceleration. The overall stock of household debt in 2019 was relatively flat compared with 2018, but there were different trends when comparing secured lending and unsecured lending. According to the Bank of Spain, the stock of consumer loans in 2019 increased 4% from a year earlier (November 2019 data), doubling GDP growth, while the stock of mortgage debt fell 1% over the same period, suggesting the mortgage market is adapting to a decelerating economy.

The combination of the decline in consumer confidence and an increase in unsecured debt will continue to put pressure on Spanish ABS. However, the effect will not be the same for all types of consumer loans. We expect that auto-loan ABS will perform better owing to these borrowers’ higher quality. But consumer loans with no specific purpose are often used by borrowers facing financial troubles in household economies, and they will likely be most negatively affected. Still, the performance of Spanish consumer-loan ABS is better than the national average of consumer NPL given the stronger eligibility criteria applied to Spanish securitisations.

Credit Outlook: 13 January 2020. Pg. 19

Moodys

You must be logged in to post a comment.