Spain, January 21, 2020 – Banco Sabadell, S.A. (Baa2/Baa3 stable, ba2) announced that it had reached an agreement to sell its 100% interest in asset management unit Sabadell Asset Management, S.A. S.G.I.I.C., Sociedad Unipersonal (SabAM), to Amundi Asset Management for €430 million. As part of the agreement, Banco Sabadell and Amundi entered a 10-year partnership. The transaction is credit positive for Banco Sabadell because it will generate a capital gain of €351 million and will improve the bank’s regulatory capital metrics.

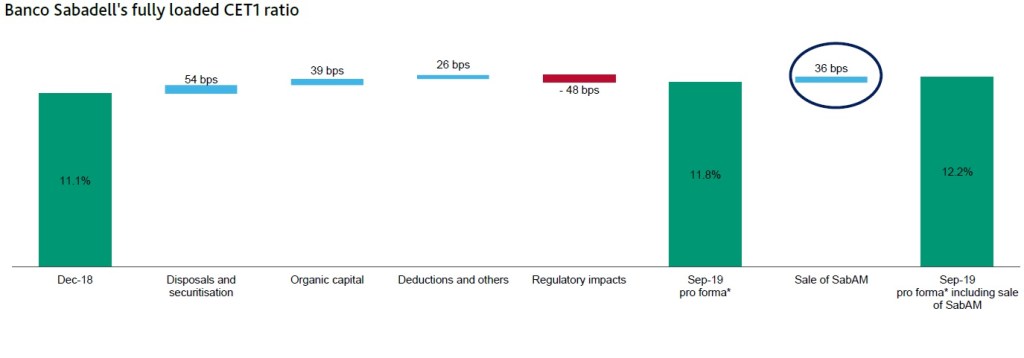

Upon the closing of the transaction, which the parties expect will occur in third-quarter 2020, Banco Sabadell estimates that its fully loaded Common Equity Tier 1 (CET1) ratio will increase 36 basis points (bps) from the pro forma fully loaded CET 1 ratio of 11.8% reported at the end of September 2019. Banco Sabadell expects an additional seven-basis-point increase related to specific guarantees in effect over the length of the distribution agreement that will be accrued proportionally over the next 10 years. This disposal is concurrent with Banco Sabadell’s strategy of divesting noncore assets and raising its fully loaded CET1 ratio to around 12%. (see exhibit)

The sale of this unit will have a relatively modest effect on the group’s profitability. Banco Sabadell disclosed that SabAM had an estimated net profit of €34 million as of year-end 2019, including, among other things, €65 million of net fee and commission income and €17 million of operating expenses. SabAM’s net profit constitutes around 4% of the bank’s annualized net income as of the end of September 2019 (net of the €135 million extraordinary gains from the Solvia disposal).

In the current environment of low interest rates and decelerating economic growth in Spain, the loss of this revenue source risks putting an additional strain on the bank’s earnings generation capacity. The sale of SabAM limits the potential growth of fee and commission income that could help ongoing challenges to Banco Sabadell’s net interest income. However, these downside risks should be broadly offset by cost savings derived from the de-risking of the bank’s balance sheet and the cost-efficiency plan, while the bank expects its subsidiary TSB Bank plc (Baa2 negative, baa2) to generate profit starting in 2020. Banco Sabadell also expects to benefit from increased distribution fees as a result of the partnership with Amundi.

Credit Outlook: 27 January 2020. Pg. 26

Moodys