Mexico, September 15, 2020 – Banco de México (Banxico), Mexico’s central bank, announced that it will extend until February 2021 pandemic related liquidity and credit measures implemented in April and which were to expire 30 September. By renewing these support measures, the government is maintaining facilities aimed at softening the negative economic and market effects of the coronavirus pandemic, which have strained bank operating conditions and investor and consumer confidence. Mexico’s economy remains weak, reflecting uncertainty about domestic policy and the US economic recovery, its largest export partner.

In Mexico, coronavirus-related measures mostly focus on liquidity, funding and some temporary rescheduling of payments, and less on subsidized credit programs or household income support, as in other countries in the region. Because Mexico’s coronavirus infection numbers are still high, risks of extended social distancing rules threaten to delay economic recovery, limit the recovery of employment and maintain low corporate earnings, which will weigh on credit conditions for at least the next 24 months.

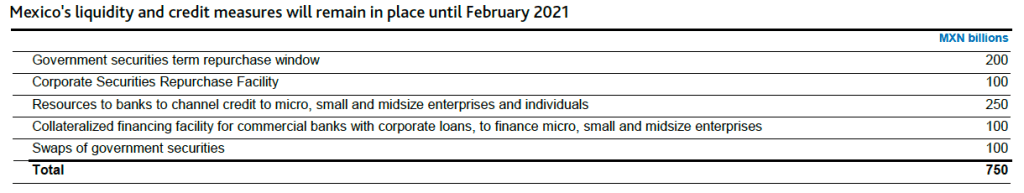

Since 21 April, Banxico has made MXN750 billion ($35 billion) available as part of its pandemic-related relief measures (see exhibit), those now extended until February 2021. The central bank has also opened its discount window to a wider range of corporate and government securities (a measure also available to development banks), lowered banks’ reserve requirements, offered secured financing at low rates and asset swaps to small and midsize enterprises (SMEs). The credit facilities directed to the SME segment most affected by the pandemic totaled MXN350 billion, a relatively small amount versus other Latin American governments’ credit lines.

Although the size and reach of the government’s package are more limited than sponsored programs implemented in other large economies in the region, the extension points to the government’s preventative stance against prevailing risks and uncertainties associated with the pandemic. The size of the measures also reflects the current administration’s commitment to fiscal austerity.

The Mexican financial system’s exposure to the SME segment, which has been most vulnerable during the economic downturn, is low and limits the need for government-sponsored aid to the sector. As of June 2020, Mexico’s systemwide loan book had about a 7% exposure to SME loans, versus 18% for Brazil and 24% for Peru. Mexican banks’ loans to large corporations, a segment with a healthier liquidity position than that of SMEs, comprised 60% of gross loans. Additionally, corporates withdrew from banks’ committed credit facilities at the outset of the pandemic, particularly in March and April, when there was a sudden drop in economic activity and heightened market volatility.

At the same time, the government has already announced that it is finalizing the regulatory framework to extend other pandemic related credit forbearance measures, including the waiver on provisioning requirement for renegotiated loans, which will support a second round of relief programs to be offered by banks to customers that continue to struggle to recover repayment capacity amid the deep economic recession.

Credit Outlook: 21 September 2020. Pg. 11

Moodys

You must be logged in to post a comment.