Brazil, February 5, 2020 – Banco Nacional de Desenvolvimento Econômico e Social (BNDES, Ba2 stable, ba21) sold its 9.9% stake in oil giant Petróleo Brasileiro S.A. – Petrobras (Petrobras, Ba2 stable), raising BRL22 billion. The divestiture will reduce BNDES’ volatility in capital and earnings, a credit positive.

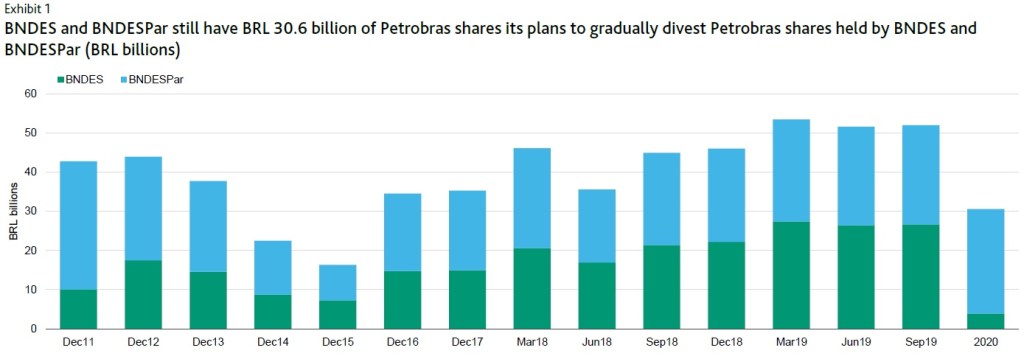

The sale does not include Petrobras preferred shares that BNDES and its investment subsidiary BNDES Participações – BNDESPar (Ba2 stable) hold. BNDES and BNDESPar also have BRL30.6 billion of voting and preferred Petrobras shares that it plans to divest within the next three years (Exhibit 1), subject to market conditions. BNDES could divest another BRL70 billion of other equity in the same time frame, depending on market conditions. To accommodate its goal, BNDES cut the value at risk limit for variable income securities in its equity portfolio to BRL600 million as of 2019 from BRL3 billion as of 2018.

Divestment proceeds will be primarily allocated to sustainable projects with relevant social and environmental impact. This strategy will support BNDES’ focus on smaller companies and having a key role within fintech and digital transformation, in addition to its preeminent position supporting infrastructure projects. Structuring and advising projects mainly related to the government’s agenda for privatizations and public-and-private partnerships also have traction in the bank’s business strategy.

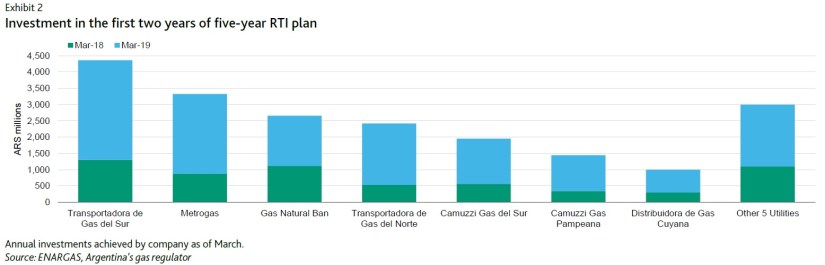

A portion of the divestment proceeds will likely be used to pay additional dividends to the Government of Brazil (Ba2 stable) to alleviate the government deficit. This practice, used 2009-13, declined after a new dividend policy that limited dividend distribution to a maximum of 60% of adjusted net income. While the bank distributed a dividend equating to 25% of adjusted net income between 2017 and 2018, in 2019, it has already anticipated dividends of 60% of adjusted net income (Exhibit 2).

We estimate that the distribution of 60% of the net gains from the sale of its Petrobras stake will not have a material effect on the bank’s capitalization because BNDES’ (Moody’s-adjusted) tangible common equity2 to risk-weighted assets ratio (TCE to RWA) should decline to 15.8%, from 17% in June 2019. BNDES has improved its capitalization since 2016, with sharply lower dividend distributions to the Government of Brazil and steady loan contraction.

For B3 S.A. – Brasil, Bolsa, Balcao (Ba1 stable), Brazil`s stock market operator, the size of secondary offering is also credit positive given that the amount traded with it is approximately 19% of the total of initial and secondary offerings that occurred in 2019. The issuance of these Petrobras shares will enable B3 to gain additional trading and post trading revenues at a time when it continues to report record levels of earnings.

Credit Outlook: 10 February 2020. Pg. 34

Moodys

You must be logged in to post a comment.